Free payroll calculator 2023

Well run your payroll for up to 40 less. Ad Compare This Years Top 5 Free Payroll Software.

2023 Calendar Pdf Word Excel

2023 Paid Family Leave Payroll Deduction Calculator.

. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Begin tax planning using the 2023 Return Calculator below. Starting as Low as 6Month. Get a head start on your next return.

Time. For example based on the rates for 2022. Free salary hourly and more paycheck calculators.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. Ad Run your business. Use this simplified payroll deductions calculator to help you determine your net paycheck.

It will be updated with 2023 tax year data as soon the. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly. Computes federal and state tax withholding for.

Get your payroll done right every time. See where that hard-earned money goes - with UK income tax National Insurance student. For example if an employee earns 1500.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. This free tax calculator is supported by Google Consumer Surveys. The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay.

20202021 2022 and 2023. 3 Months Free Trial. Free Unbiased Reviews Top Picks.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The US Salary Calculator is updated for 202223. Big on service small on fees.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free 2022. Payroll Payroll services and support to keep you compliant. Small Business Low-Priced Payroll Service.

Try for FreePay When You File. SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay INCOME Which. Find my W-2 online.

Self-Employed TurboTax Live TurboTax Live Full Service or. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Heres a step-by-step guide to walk you.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. TAX DAY IS APRIL 17th. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Free Unbiased Reviews Top Picks.

To run payroll you. How to calculate annual income. An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options tax allocations.

Ad See the Payroll Tools your competitors are already using - Start Now. The Calculator will ask you the following questions. GetApp has the Tools you need to stay ahead of the competition.

Sign up for a free Taxpert account and e-file your returns each year they are due. Contractors - LTD Company v Umbrella. To use our Free TDS calculator to calculate TDS for your employees.

This calculator is integrated with a W-4 Form Tax withholding feature. For example if an employee earns 1500. Return filed in 2023 2021 return filed in 2022.

TurboTax offers a free suite of tax calculators and tools to help save you money all year long. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Super contribution caps 2021 - 2022 - 2023.

Ad Compare This Years Top 5 Free Payroll Software. Wage withholding is the prepayment of income tax. The standard FUTA tax rate is 6 so your max.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Grade Book Templates 13 Free Printable Doc Pdf Xlx Grade Book Grade Book Template Templates

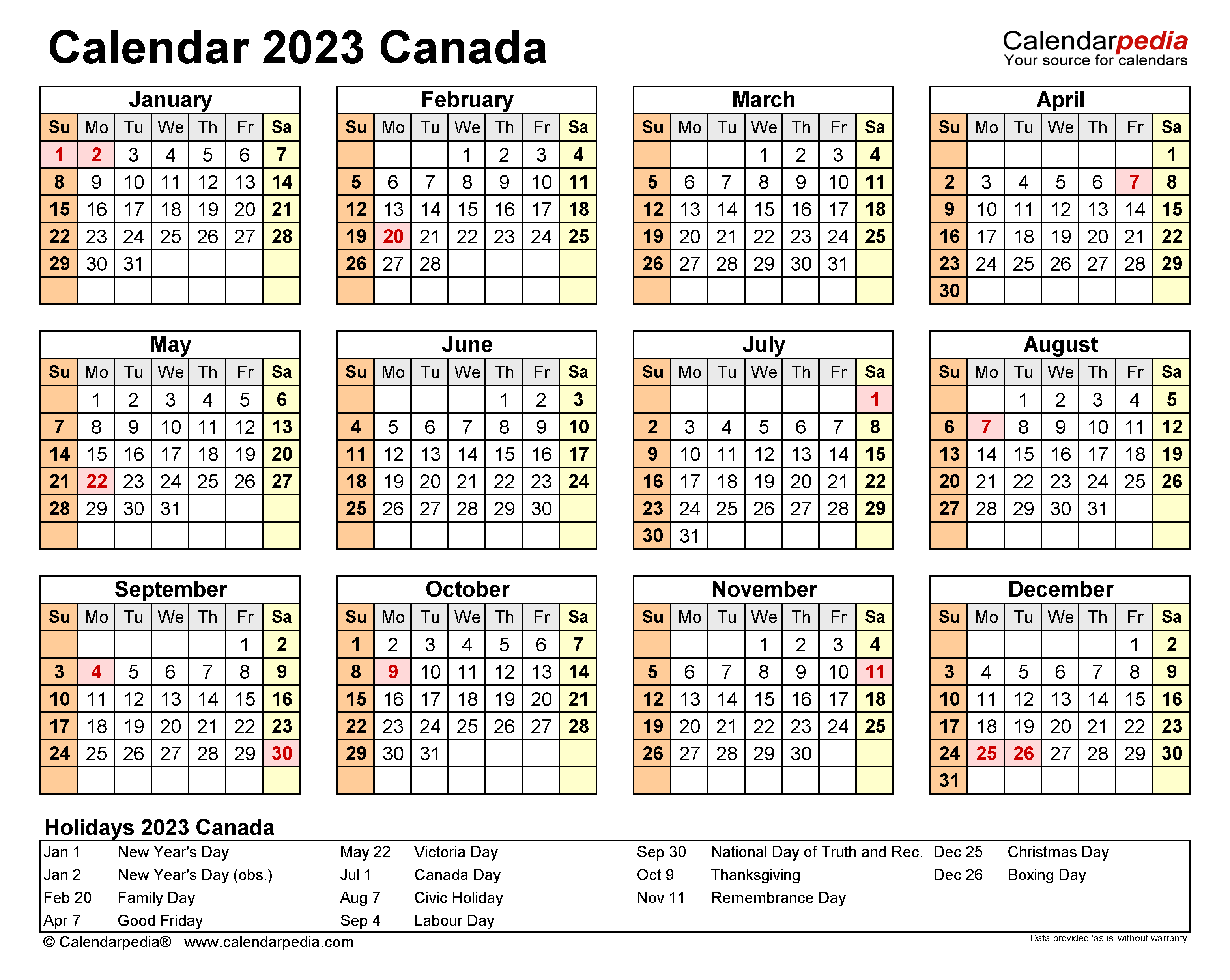

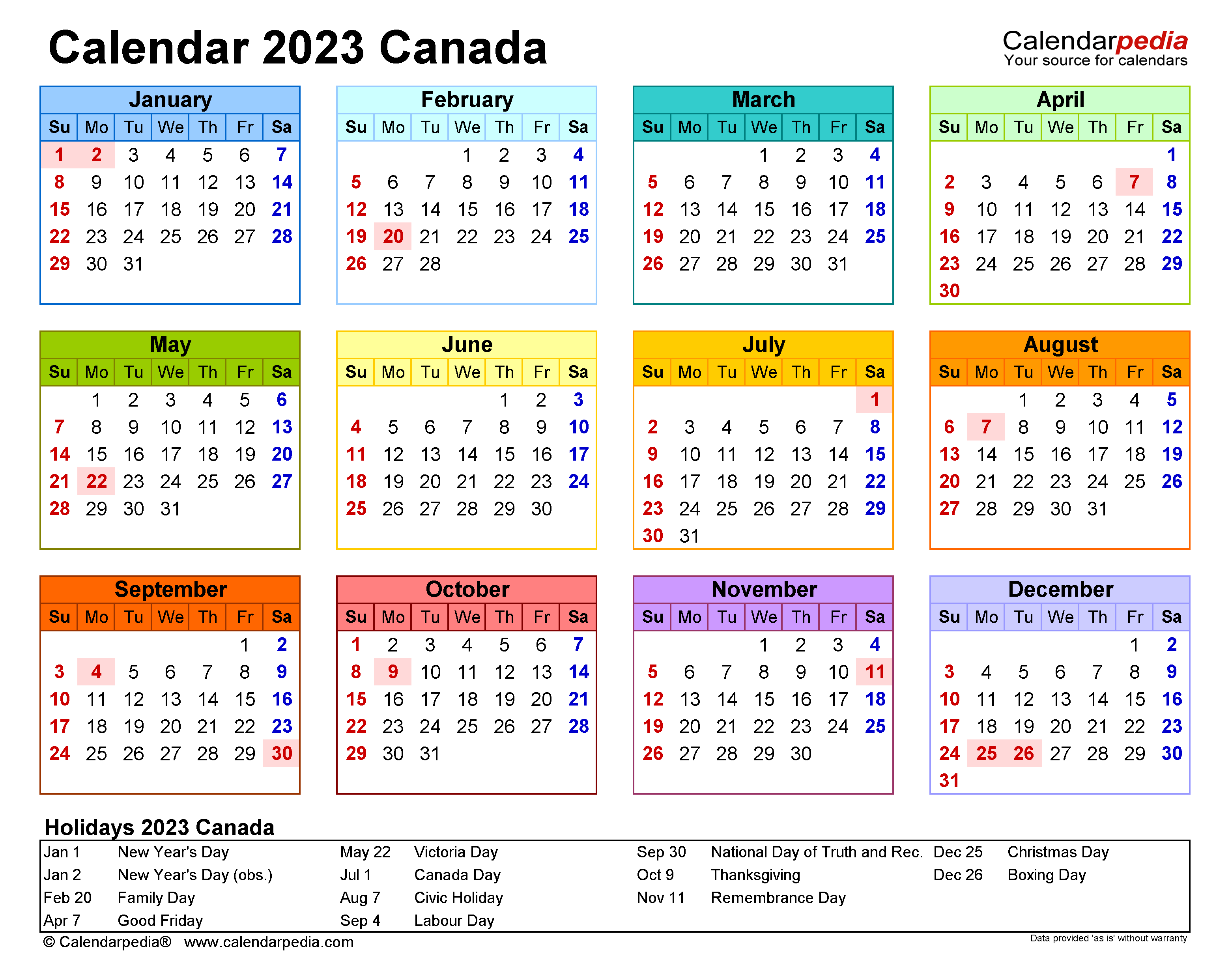

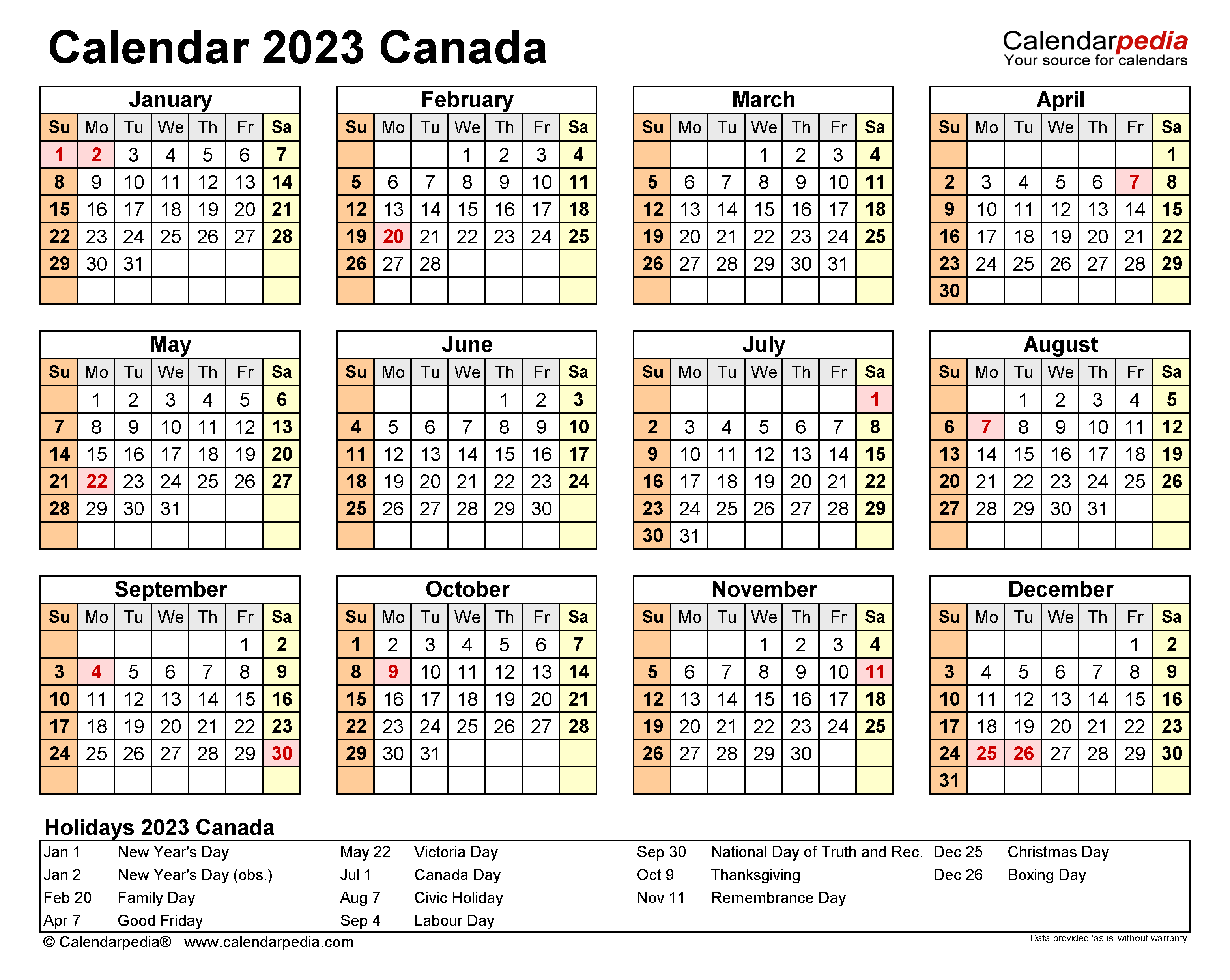

2023 Calendar Pdf Word Excel

2023 Calendar Free Printable Excel Templates Calendarpedia

2023 Calendar Pdf Word Excel

3

Canada Calendar 2023 Free Printable Excel Templates

2023 Calendar Pdf Word Excel

Canada Calendar 2023 Free Printable Excel Templates

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

2023 Calendar Pdf Word Excel

Canada Calendar 2023 Free Printable Excel Templates

1

1

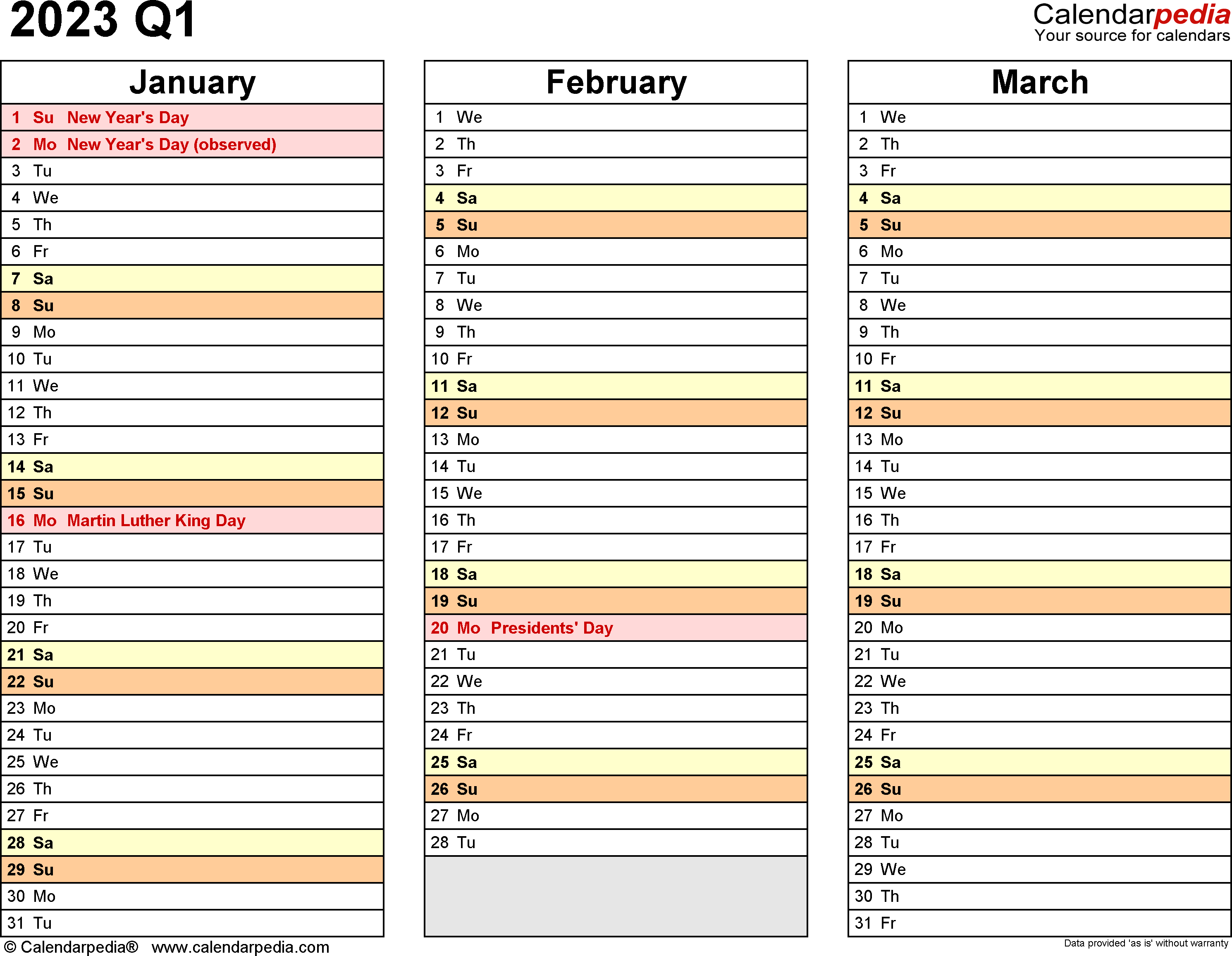

Quarterly Calendars 2023 Free Printable Pdf Templates

2023 Calendar Pdf Word Excel

Payroll Template Free Employee Payroll Template For Excel

1